Real Estate Sales Records Ct

Connecticut Land Registry Pilot

Connecticut Land Registry Pilot The Public Use and Benefit Land Registry (Land Registry) pilot portal allows users to browse state lands, determine property ownership, and research, view, and download copies of parcel information, including deeds, surveys, and land management plans. Greater levels of detail are available as the map zoom level is increased.

https://portal.ct.gov/DEEP/Open-Space/Connecticut-Land-Registry-Pilot

Connecticut Online Database - Vision Government Solutions

Click on your municipality below to view your information:...

https://www.vgsi.com/connecticut-online-database/

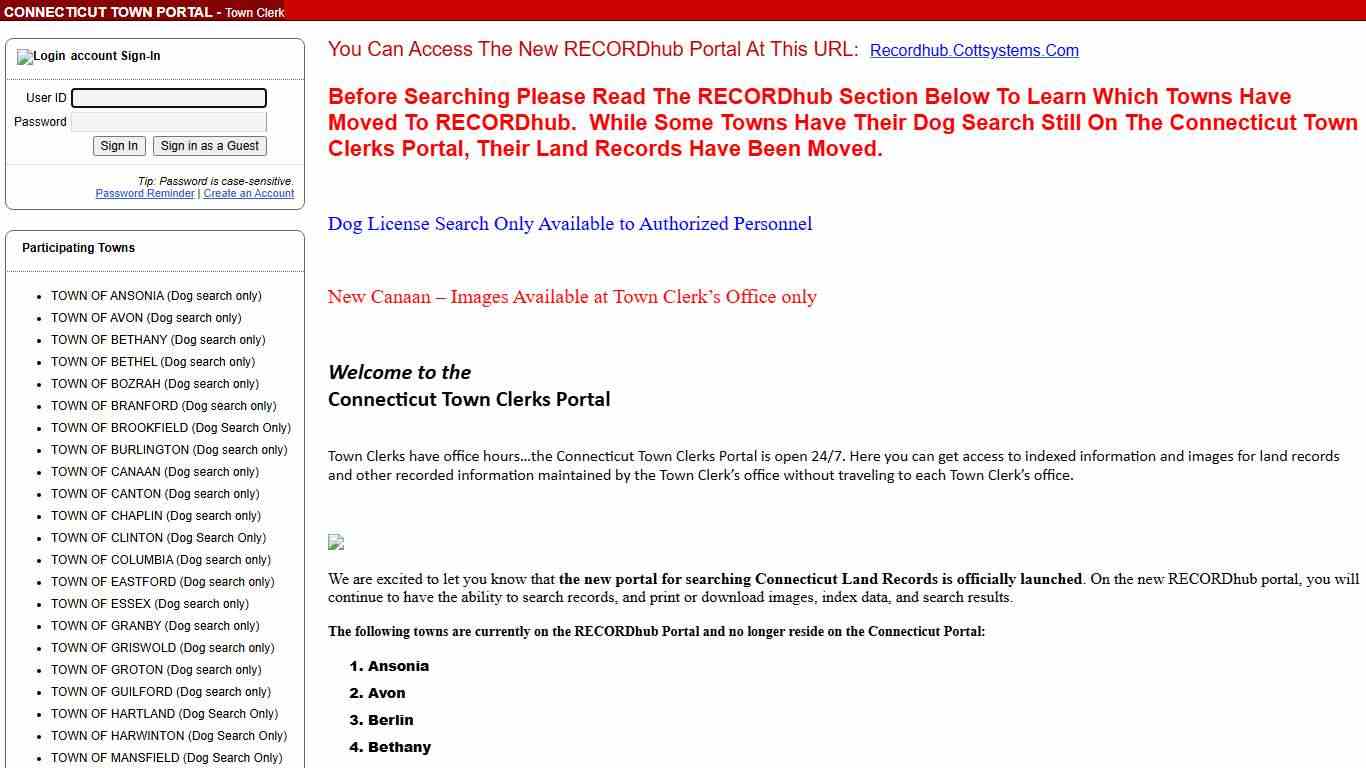

eSearch Account Sign In

You can access the new RECORDhub portal at this URL: recordhub.cottsystems.com Before searching please read the RECORDhub section below to learn which towns have moved to RECORDhub. While some towns have their Dog search still on the Connecticut Town Clerks Portal, their land records have been moved.

https://connecticut-townclerks-records.com/

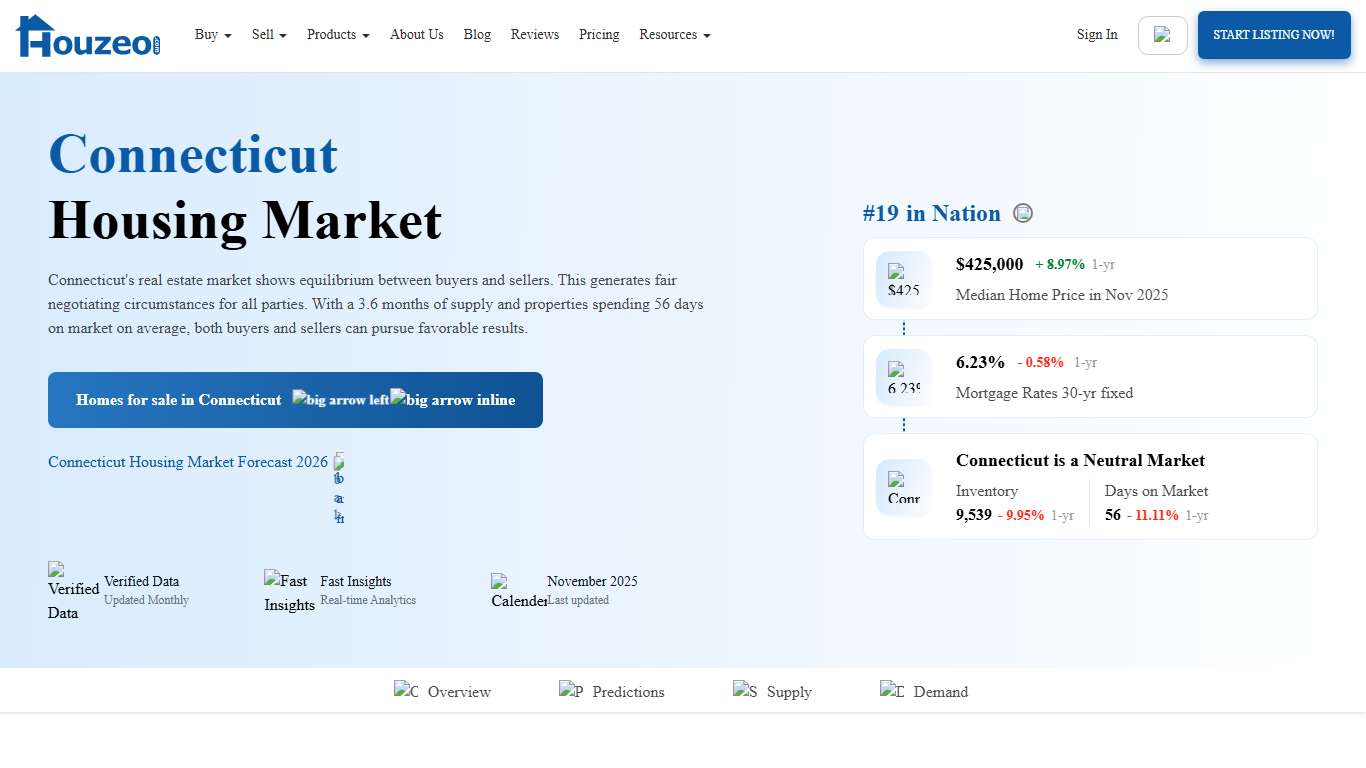

Connecticut Housing Market in 2026: Home Prices & Trends Houzeo

Median Sale Price $425,0008.97% year-over-year What does this mean? Connecticut's balanced market conditions are expected to continue through 2026, creating fair opportunities for both buyers and sellers as the market stabilizes with modest rate improvements. Days on Market: 56 days Months of Supply: 3.6 months Sale-to-List Ratio: 100% Mortgage Rates: Currently- 6.23% projected to hover between 6.0% and 6.8% # of Homes for Sale 9,5399.95% year...

https://www.houzeo.com/housing-market/connecticut

Recently Sold Homes in Connecticut (CT)

238 Sylvan Lake Rd, Watertown, CT 06779. tour available. Property detail for 238 Sylvan Lake Rd Watertown, CT 06779. Sold - Jan 29, 2026. $400,000. 3bed; 1.5 ...

https://www.realtor.com/realestateandhomes-search/Connecticut/show-recently-soldAssessor's Office Westport, CT

... 2026. Property information will be obtained from inspections, data mailers, building permits, sales verifications and data analysis. For more information ...

https://www.westportct.gov/government/departments-a-z/assessor-s-officeOffice of the Tax Assessor – City of Hartford

The mission of the Assessment Division is to estimate the fair market value of all real property, personal property, and motor vehicles, to establish the fair and equitable levy of local property tax. The Assessor is the local government official responsible for establishing the fair market value of all real property, personal property and motor vehicles for local property tax purposes.

https://www.hartfordct.gov/Government/Departments/Assessor

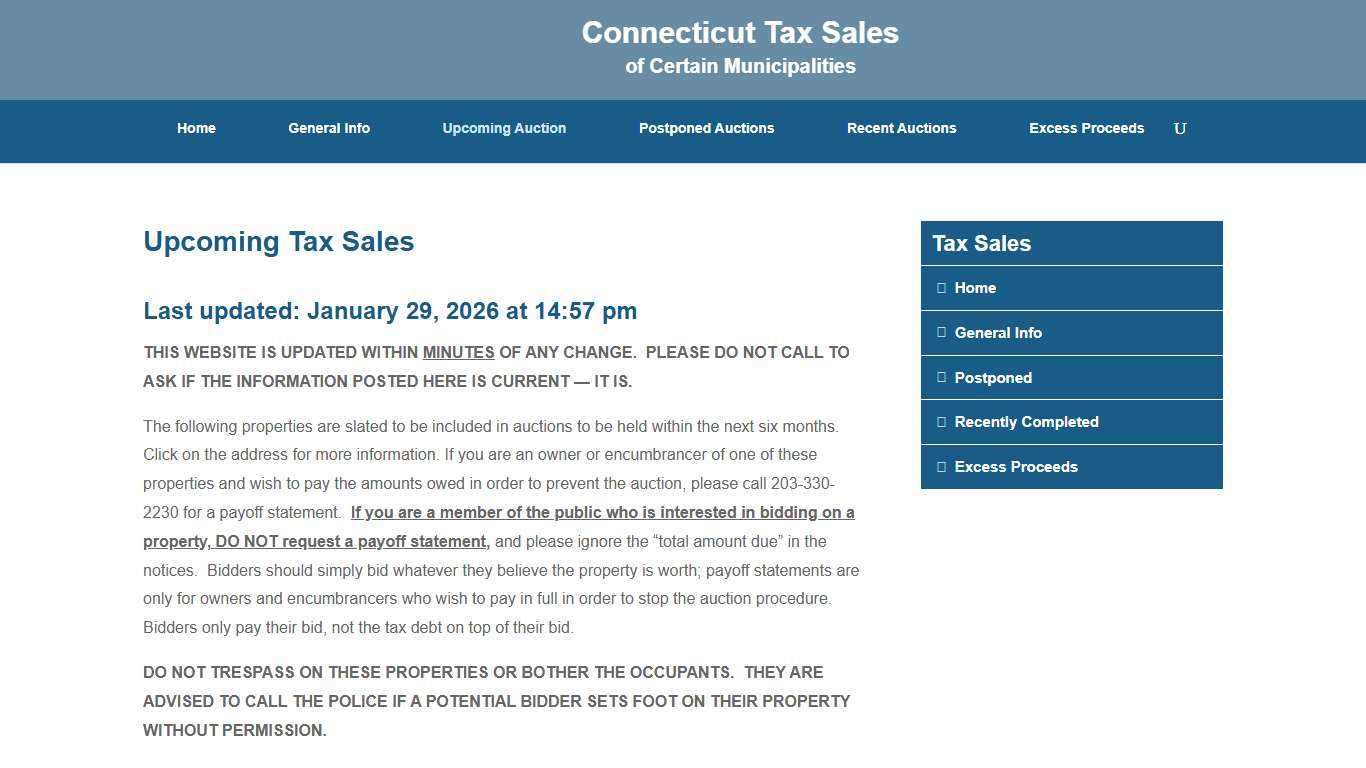

Upcoming Tax Sales Connecticut Tax Sales

Last updated: January 29, 2026 at 14:57 pm THIS WEBSITE IS UPDATED WITHIN MINUTES OF ANY CHANGE. PLEASE DO NOT CALL TO ASK IF THE INFORMATION POSTED HERE IS CURRENT — IT IS. The following properties are slated to be included in auctions to be held within the next six months.

https://cttaxsales.com/upcoming-tax-sales/

onlineenquiry

Business Owners - Go here if you received a Notice of Intent to Dissolve or Revoke. Go here if you received a Certificate of Dissolution or Revocation. Not sure? The letter you received will be located under your most recent business filing history. Search for your business here.

https://service.ct.gov/business/s/onlineenquiry?language=en_US

Why It May Be Easier for Some to Sell or Refinance Their Home in 2026 - Northeast Law Center

Why It May Be Easier for Some to Sell or Refinance Their Home in 2026 Attorney Kate Cerrone Beginning January 1, 2026, Connecticut property owners and real estate professionals will benefit from an important update to the state law governing old mortgages that were never properly released of record.

https://nectlaw.com/connecticut-updated-unreleased-mortgage-law-2026-kate-cerrone/

Smart Moves Before the New Year: Legal Steps to Protect Your Real Estate Investments in 2026 - Northeast Law Center

Smart Moves Before the New Year: Legal Steps to Protect Your Real Estate Investments in 2026 Attorney Kate Cerrone As 2025 draws to a close, real estate investors in Connecticut have a valuable opportunity to strengthen their portfolios and position themselves for success in the coming year.

https://nectlaw.com/legal-steps-to-protect-your-real-estate-investments-in-2026-kate-cerrone/

Disclosure Requirements for Selling Connecticut Real Estate (2026)

Home sellers in Connecticut are required by law to disclose detailed information about the status and condition of their property. They need to fill out the Residential Property Condition Disclosure Report or another form that complies with state law to inform buyers about what they're potentially purchasing.

https://listwithclever.com/real-estate-blog/disclosure-requirements-for-selling-connecticut-real-estate/

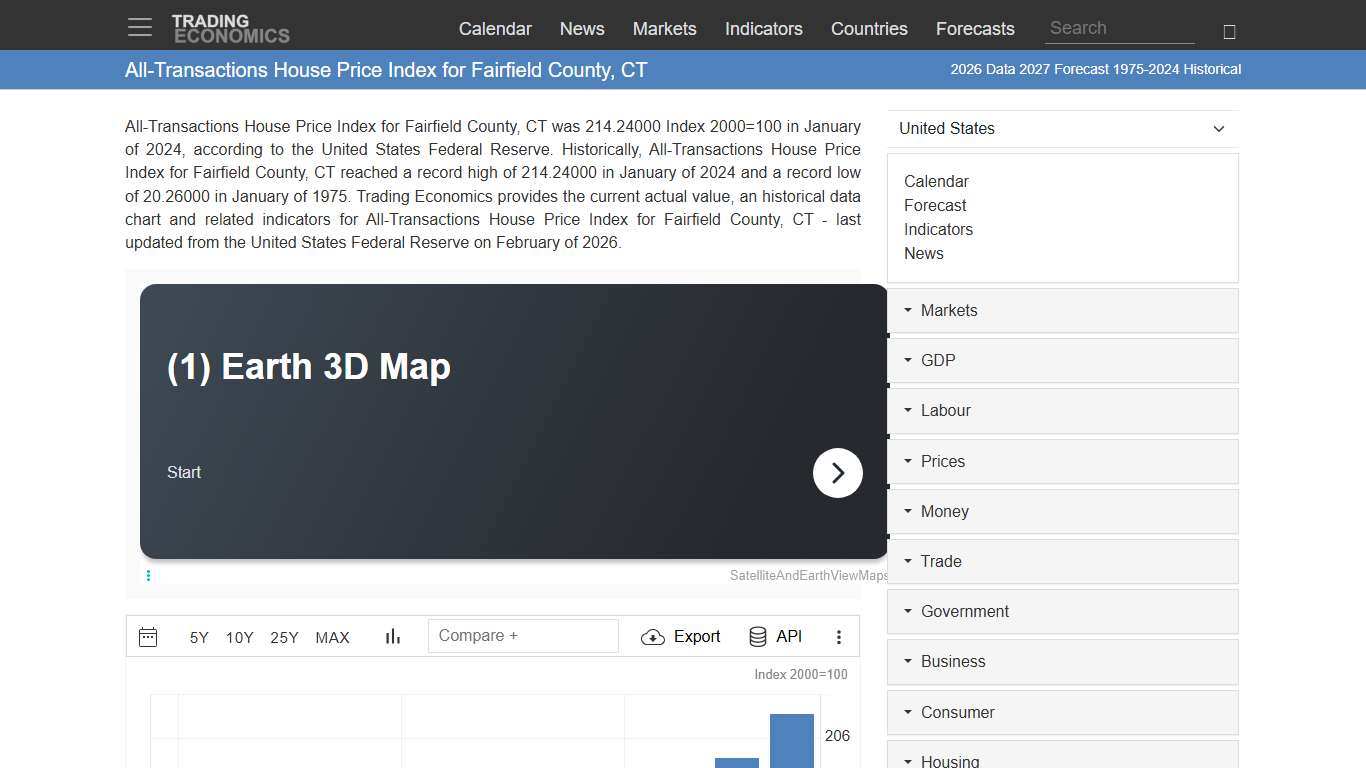

All-Transactions House Price Index for Fairfield County, CT - 2026 Data 2027 Forecast 1975-2024 Historical

All-Transactions House Price Index for Fairfield County, CT was 214.24000 Index 2000=100 in January of 2024, according to the United States Federal Reserve. Historically, All-Transactions House Price Index for Fairfield County, CT reached a record high of 214.24000 in January of 2024 and a record low of 20.26000 in January of 1975.

https://tradingeconomics.com/united-states/all-transactions-house-price-index-for-fairfield-county-ct-fed-data.html

eSearch Account Sign In

You can access the new RECORDhub portal at this URL: recordhub.cottsystems.com Before searching please read the RECORDhub section below to learn which towns have moved to RECORDhub. While some towns have their Dog search still on the Connecticut Town Clerks Portal, their land records have been moved.

https://connecticut-townclerks-records.com/

Connecticut Tax Sales of Certain Municipalities

This webpage contains copies of public notices issued by certain Connecticut municipalities relating to auctions they have slated to collect unpaid taxes and other charges under Connecticut General Statutes § 12-157. ATTENTION: Disclaimer This webpage and its contents are for general informational use only, and are not legal advice.

https://cttaxsales.com/

Office of the Tax Assessor – City of Hartford

The mission of the Assessment Division is to estimate the fair market value of all real property, personal property, and motor vehicles, to establish the fair and equitable levy of local property tax. The Assessor is the local government official responsible for establishing the fair market value of all real property, personal property and motor vehicles for local property tax purposes.

https://www.hartfordct.gov/Government/Departments/Assessor